Faysal Bank Islamic Personal Installment Loan

If you are searching for Faysal Bank Islamic Personal Installment Loan 2026, this complete guide is written especially for you. In Pakistan, many people need quick cash for important needs like weddings, children’s education, medical emergencies, home renovation, or urgent family expenses. Faysal Bank, one of the leading Islamic banks in Pakistan, offers a Shariah-compliant, Riba-free personal installment loan that is easy to understand and simple to manage.

This financing facility is based on the Tawarruq Islamic model, approved by recognized Shariah scholars. It gives you peace of mind because there is no interest involved, no hidden charges, and your monthly installment is fixed from day one. Both salaried and self-employed Pakistanis can apply for this facility in 2026.

Quick Information Table – Faysal Bank Islamic Personal Installment Loan 2026

| Field | Details |

|---|---|

| Name of Program | Faysal Bank Islamic Personal Installment Loan |

| Start Date to Apply | Ongoing (January 2026) |

| Last Date to Apply | Open throughout 2026 (subject to bank policy) |

| Bank Name | Faysal Bank Limited (Islamic Banking) |

| Total Financing Amount | PKR 50,000 to PKR 4,000,000 |

| Return Time (Tenure) | 12 to 48 months |

| Cities | Karachi, Lahore, Islamabad, Rawalpindi, Faisalabad, Multan, Peshawar, Quetta and other major cities |

| Province | Punjab, Sindh, KPK, Balochistan, ICT |

| Amount of Assistance | Up to PKR 4 million (based on income) |

| Method of Application | Online & Branch Visit (Offline) |

Faysal Bank Islamic Personal Installment Loan – Complete Overview

The Faysal Bank Islamic Personal Installment Loan is designed for people who want Halal financing without complications. Instead of charging interest, the bank uses the Tawarruq structure, where a real asset-based transaction is done, and profit is fixed in advance.

Key Features at a Glance

| Feature | Details |

|---|---|

| Financing Amount | PKR 50,000 to PKR 4,000,000 |

| Tenure Range | 12 to 48 months |

| Islamic Model | Tawarruq (Shariah-compliant) |

| Processing Fee | PKR 8,000 + FED |

| Minimum Income (Salaried) | PKR 50,000 per month |

| Minimum Income (Business) | PKR 100,000 per month |

| Age Requirement | 18 to 70 years |

| Profit Rate | Competitive fixed rates (declared at approval) |

Why People Prefer Faysal Bank Islamic Personal Loan

Transparent and Fixed Installments

One major reason Pakistanis prefer this loan is clarity. Your monthly installment is fixed, so you know exactly how much you will pay every month. There are no surprises later.

100% Shariah-Compliant

For many families in Pakistan, avoiding Riba is a religious duty. This loan follows Islamic principles, making it suitable for people who want Halal financial solutions.

High Financing Limit

With financing of up to PKR 4 million, this loan can easily cover big expenses like weddings, overseas education fees, medical treatments, or business support.

Nationwide Availability

Faysal Bank Islamic branches are available in almost all major cities, making it accessible across Pakistan.

Eligibility Criteria for Faysal Bank Islamic Personal Loan

Before applying, make sure you meet the eligibility requirements.

Basic Eligibility Requirements

| Requirement | Details |

|---|---|

| Citizenship | Pakistani |

| Age Limit | 18 to 70 years (at loan maturity) |

| Minimum Income (Salaried) | PKR 50,000 per month |

| Minimum Income (Self-Employed) | PKR 100,000 per month |

| Job Experience | 6 months current job / 1 year total |

| Business History | Minimum 1 year |

Your CNIC must be valid, and your income should be verifiable through bank statements or official documents.

Application Process for the Faysal Bank Islamic Loan

Applying for this loan in 2026 is simple and user-friendly.

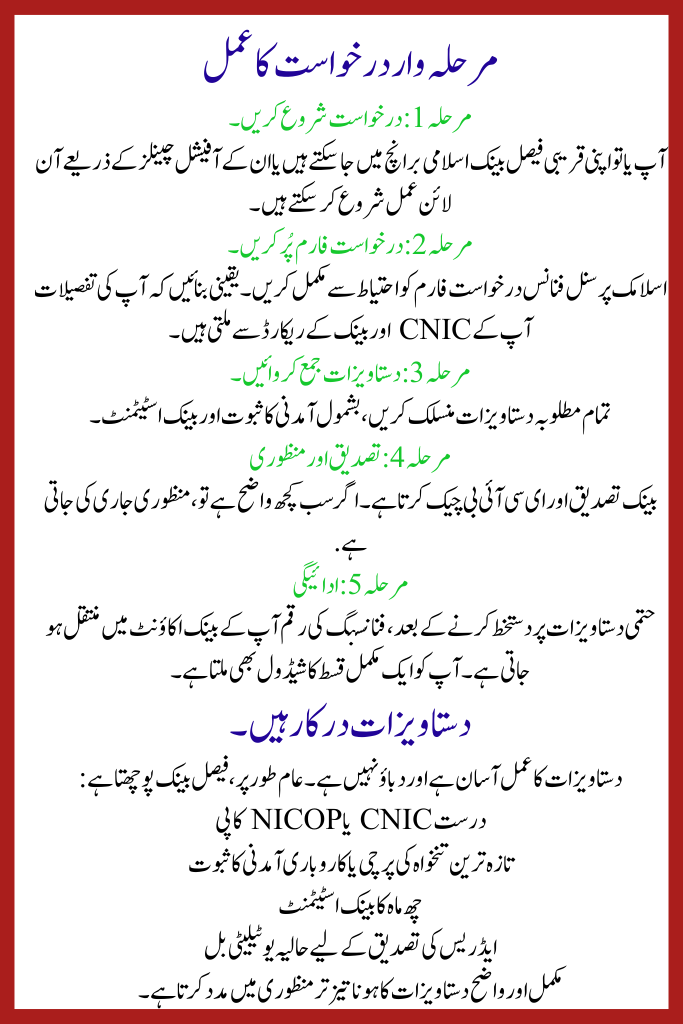

Step-by-Step Application Process

Step 1: Start Application

You can either visit your nearest Faysal Bank Islamic branch or start the process online through their official channels.

Step 2: Fill Application Form

Complete the Islamic Personal Finance application form carefully. Make sure your details match your CNIC and bank records.

Step 3: Submit Documents

Attach all required documents, including income proof and bank statements.

Step 4: Verification and Approval

The bank conducts verification and an eCIB check. If everything is clear, approval is issued.

Step 5: Disbursement

After signing final documents, the financing amount is transferred to your bank account. You also receive a full installment schedule.

Documents Required

The documentation process is simple and not stressful. Usually, Faysal Bank asks for:

- Valid CNIC or NICOP copy

- Latest salary slip or business income proof

- Six-month bank statement

- Recent utility bill for address verification

Having complete and clear documents helps in faster approval.

Faysal Bank Loan Fees and Charges Explained Simply

The cost structure is transparent:

Main Charges

- Processing Fee: PKR 8,000 + FED (one-time)

- Late Payment: A small charity amount (donated, not bank income)

- Other Charges: Government taxes and stamp duty as per 2026 regulations

There are no hidden interest charges, which makes this facility stress-free.

Important Things to Know Before Applying

- Your installment amount depends on income and tenure

- Early settlement rules apply as per bank policy

- Insurance or Takaful may be included for protection

- Always confirm final rates at the branch before signing

Final Thoughts

The Faysal Bank Islamic Personal Installment Loan 2026 is an excellent option for Pakistanis who want quick, Halal, and transparent financing. With flexible repayment options, fixed monthly installments, and nationwide availability, it covers both financial needs and peace of mind.

Whether you are planning a wedding, managing education expenses, or facing an emergency, this Riba-free facility gives you support without compromising your beliefs.

FAQs

What is the maximum loan amount?

You can get financing from PKR 50,000 up to PKR 4,000,000, depending on your income and repayment capacity.

Is this loan completely interest-free?

Yes. It is Shariah-compliant and based on the Tawarruq Islamic model, not conventional interest.

Can self-employed people apply?

Yes. Business owners and professionals with at least one year of business history can apply.

How long does approval take?

Normally, approval and disbursement take 7 to 10 working days after complete document submission.

If you want, I can also rewrite this article for blog posting, news website, or YouTube script style.